Supporting copy for the Request Service

call out button.

Serving the Entire U.S. 443-922-7063

877-214-9477

FAQs

Helpful FAQs

What Are the Advantages of Using Credit Repair Now?

It's true that there are a lot of companies out there who refer to themselves as "credit repair organizations," however, many of them don't have the experience and expertise required to effectively represent your dispute efforts. Advantages of working with Credit Repair Now include:

- We have the ability to dispute claims directly with creditors

- Our team researches and stays current with consumer laws and changes, their interpretations, and the applicability of those laws

- We strictly govern ourselves according to the principles and rules of professional conduct

How Much Does Bad Credit Cost?

Simply put, the cost of bad credit is small when compared to the cost of living with bad credit. We've listed a few examples below.

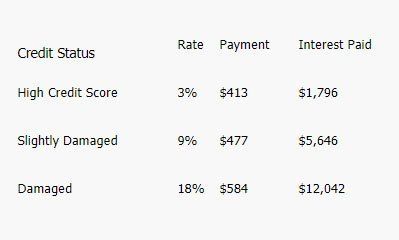

If you're currently making car payments, it's likely that you are paying somewhere between $4,000.00 - $10,000.00 more over the course of the loan simply because of bad credit. Added interest

shows up every month as a higher payment. Example:

Car Loan: Car Loan: $23,000 car financed for five years:

Home Loan

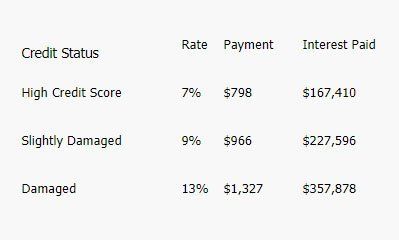

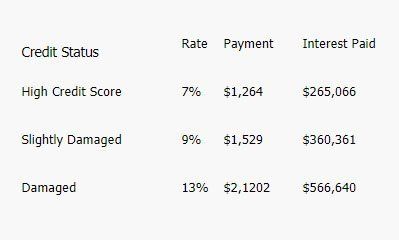

The effect of bad credit on a vehicle is incredibly low when compared to the effect of bad credit on a home loan. A typical home in the United States will cost somewhere between $180,000.00 and $300,00.00 more interest (30 year loan) if you're buying with bad credit. Example:

$120,000.00 home paid over 30 years:

$190,000.00 home paid over 30 years:

Credit Cards

Generally speaking, you won't be able to get an unsecured credit card if you've got damaged credit. The accounts that you will be approved for will most likely have much higher rates and lower limits. You can save on future interest fees by restoring your credit now.

How Long Have You

Our staff has more than 10 years of experience repairing credit and challenging credit reporting companies. Working with lawyers, bankers, underwriters, and accountants, we make credit repair simple. We utilize innovative solutions (always adhering to the relevant laws and regulations) to solve your problems.

How Do You Restore Bad Credit?

As soon as we receive your credit reports, we'll begin analyzing your credit history to identify the items that are responsible for reducing your score. The next step is to draft letters disputing the negative items for you. And while we encourage all of our clients to dispute their own claims (if you have the time and knowledge), it's important to remember that credit bureaus are allowed to ignore your claims for a number of reasons.

Over the past 10 years we've noticed that a high percentage of disputes sent directly from consumers are immediately rejected. Our letters are expertly designed in a way that will require bureaus to accept them.

For a disputed credit listing to remain on your report, it must be verified as accurate. If the listing contains an error, the credit bureau can fix it. These often go unverified because the bureau either no longer has the information required or does not put forth the effort. Investigations must be completed within 30 days. For these and other reasons, disputed claims are often removed from your report.

How Long Does It Take?

Most clients will see progress within the 45 days of service. Unfortunately, the majority of our time is spent waiting or credit bureaus to respond to our requests. We make every effort to get our disputes to the bureaus as quickly as we possibly can. As an example, a client with 7 - 10 items on their credit report should be prepared to wait at least three to four months.

Do You Guarantee Results?

By law, no one can guarantee that they'll have items removed from your credit report. However, we stand by our services and, if you feel as though you have not got the necessary results, we will certainly evaluate your accounts and refund a certain portion of your payment. Refer to our money back guarantee

for details.

What if the Removed Items Reappear?

Occasionally, this will happen (by accident or if a creditor is able to verify a claim). This is referred to as a "soft delete." The FCRA (Fair Credit Reporting Agency) has made it difficult for creditors to replace items once they've been removed and we'll always re-challenge them if they show up again.

Is This Legal?

Absolutely. Under the FCRA Act you have the right to challenge items appearing on your credit report. Our staff will use every tool and technique necessary to protect and assert these rights.

What Is My Credit Score Based On?

Credit scores are based on many factors, including:

- Amount of available credit

- Payment history

- Recent requests for credit

- Amount of credit currently being used

- Length of credit history

Under the Equal Credit Opportunity Act, credit scoring may not use gender, race, martial status, national origin, or religion as factors.

How Can Bad Credit Be Deleted?

The good news is that negative credit listings are removed from credit reports every single day. We are hard at work 24/7 challenging credit entries on behalf of our clients. Using proven and legal methods, we will help restore your credit.

Why Do I Need to Pay My Bills?

When negative items are deleted from a credit report, the actual debt remains. You're still responsible for the same amount of money you did in the beginning. If you fail to pay the debt, a creditor or collection agency can report the item again. Removing a listing without paying off the debt is a temporary solution.

FREE

Credit Consultations

Have questions you don't see here? Give us a call anytime.

443-922-7042

Quick Links

Contact Us

Credit Repair Now

Edgewood, MD 21040

Mailing Address:

1010 Edgewood Road, Suite 106

Edgewood, MD 21040

Phone: 443-922-7063

Toll Free: 877-214-9477

Fax: 443-922-7091

Contact Name: John Gonzalez

Privacy Policy

| Do Not Share My Information

| Conditions of Use

| Notice and Take Down Policy

| Website Accessibility Policy

© 2025

The content on this website is owned by us and our licensors. Do not copy any content (including images) without our consent.